Client type: International maritime / travel-related operations

Location: Colombia

Type of care: Emergency and inpatient medical services

AP Companies’ role: Medical governance, deep audit, hidden risk detection

Outcome: USD 27,885 in unjustified medical spend identified and prevented — costs that would have passed standard review

Backgound

In 2025, AP Companies was asked to review a series of medical invoices submitted for reimbursement following treatment abroad.

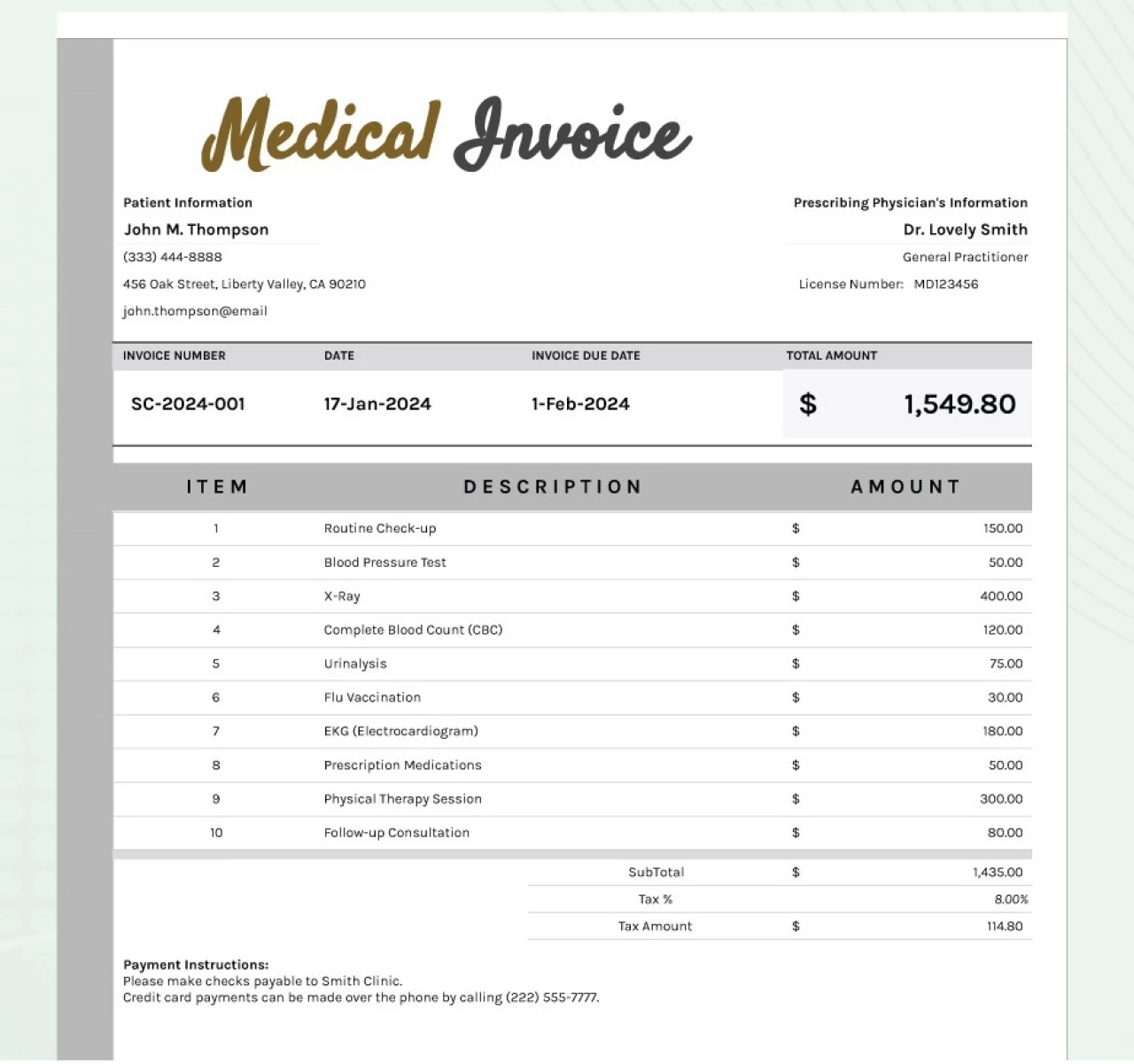

At first glance, the documentation appeared formally correct: electronic invoices, matching totals, valid medical codes.

For most organizations, this would have marked the end of the review.

What Didn’t Add Up — and Why It Matters

In complex international cases, risk rarely appears as an obvious error.

It hides in areas that are typically not examined:

- whether the invoice submitted for reimbursement matches what is actually registered in government systems,

- whether the medical services listed make clinical sense within a single episode of care,

- whether certain services could realistically occur simultaneously,

- whether the pricing reflects real medical practice in the local market.

Without local access and clinical context, these questions remain unanswered.

What AP Companies Did Differently

AP Companies went beyond a document-based review.

We applied an approach that cannot be replicated remotely:

1. Validation beyond the invoice itself

We cross-checked the versions submitted for reimbursement against what was officially recorded in government systems.

This immediately revealed discrepancies invisible to accounting teams and automated controls.

2. Clinical logic over formal correctness

Each line item was assessed through a medical lens:

- clinical necessity,

- timeline consistency,

- alignment with accepted standards of care.

This step exposed services that could not have been delivered as claimed, despite formally valid documentation.

3. Local access, not third-party copies

Through AP Companies’ regional network, original electronic records were obtained directly from official systems — not from intermediaries.

This provided a factual baseline that could not be manipulated.

4. Real market pricing, not global averages

Instead of relying on generalized benchmarks, pricing was evaluated against actual local practice and reference tariffs within the region.

What Was Identified

The review confirmed that:

- altered versions of invoices were submitted for reimbursement,

- certain services were medically incompatible within the same episode of care,

- routine medical items were inflated by several hundred percent,

- the actual cost of care differed materially from what was claimed.

Result:

USD 27,885 in hidden overbilling — costs that appeared compliant under standard review but were uncovered through medical and local validation.

Why Standard Reviews Miss This

Most systems verify:

- document presence,

- arithmetic accuracy,

- formal compliance.

AP Companies verifies:

- whether care actually occurred as claimed,

- whether it made medical sense,

- whether the documentation reflects reality on the ground.

These are fundamentally different levels of control.

Conclusion

This case demonstrates that meaningful cost containment in international healthcare does not begin with price negotiation or post-payment recovery.

It begins with understanding where medical decisions are made, and having the capability to validate them locally, clinically, and structurally.

That is the difference between standard review — and medical governance by AP Companies.